Real Estate Data

Housing Statistics – National Association of REALTORS®

NAR produces housing statistics on the national, regional, and metro-market level where data is available. All current data produced by NAR is available on altor. For indicators on state, city, and county levels, please contact state and local REALTOR® associations.

For more information, use the links below to see each indicator’s methodology page. You will also find a list of resources on our Research and Data FAQ page. All historical reports and data can be found in the REALTOR® Store.

NAR research data release dates

Citation guidelines for NAR research and statistics

Expand all

NAR releases national and regional existing-home sales price and volume statistics on or about the 25th of each month. Each report includes data for 12 months and annual totals going back three years. Reports are available for existing single-family homes, condos, and co-ops. Both median and average prices are included.

See Existing-Home Sales data.

This leading indicator for housing activity is released during the first week of each month. The index measures housing contract activity. It is based on signed real estate contracts for existing single-family homes, condos, and co-ops.

See Pending Home Sales Index data.

The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent monthly price and income data.

See Housing Affordability Index data.

The REALTORS® Affordability Distribution Curve and Score measures housing affordability at different income percentiles for all active inventory on the market. For each state, REALTORS® Affordability Distribution Curve shows how many houses are affordable to households ranked by income while REALTORS® Affordability Distribution Score is the measure which is intended to represent affordability for all different income percentiles in a single measure.

See REALTORS® Affordability Distribution Curve and Score data.

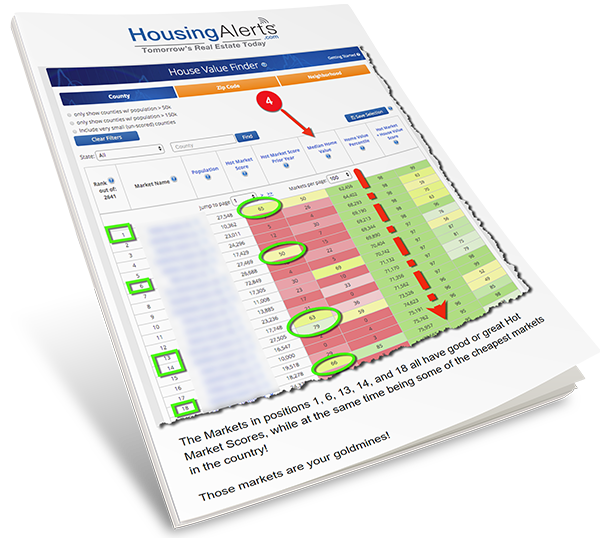

NAR releases statistics on metropolitan area housing affordability and metropolitan area median home prices each quarter. Two separate price reports reflect sales prices of (1) existing single-family homes and (2) condominium and cooperative homes by metropolitan statistical area (MSA). A quarterly qualifying income report shows the income that is needed to qualify to purchase the median priced existing single-family home in each metro area given a variety of downpayment assumptions. To find the annual housing affordability index by MSA, see the “Housing Affordability Index” data.

See Metropolitan Median Home Prices and Affordability data.

To calculate median home values for 3, 119 counties and county-equivalents in the United States, NAR applied the House Price Index growth from FHFA to the latest housing data from the American Community Survey (ACS). Home values represent the value of all homes instead of home sales.

Monthly mortgage payments by county are based on the following mortgage rates: 3. 0%, 3. 5%, and 4. 0%.

See County Median Home Prices and Monthly Mortgage Payment.

This measure computes how many new permits are issued for every new job for 178 metro areas.

See housing shortage data.

What Are the Best Public Sources of Real Estate Data? – Realtyna

23 May 2020

Posted at 11:00h

0 Comments

Real Estate is one of the most data-consuming businesses in our world today. From demographics data to statistics and market reports, there is a myriad of information to be analyzed and processed. There are several public sources of real estate data in the US, most of which are free. These sources of data are essential to the success of real estate marketing and development strategies. Let ‘s dive in:There are general depositories of statistics and related data you can access. Some are run by the federal government like and others are provided by public or private institutions. In the following, you can find a list of real estate data resources every real estate professional show know of:ResourceType of DataAccess Stats, demographics, techFreeAssociated General Contractors of America: Economic DataConstruction economicsFree BRB Publications: Public RecordsStats, cities and countiesFreeUS EPA Environmental InformationEnvironmental, mapping, bidding mDemographicsFree mNeighborhood dataFreeUS CensusDemographics, business, revenue, etcFree ZapDataUser data analysisPaidGoogle services (maps, Earth, etc)Maps and geodatabothNational Center for Assisted LivingConsumer info and researchFree Country and International Research Guide*National and international HBS researchFreeNational Multi Housing CouncilMarket trends and reportsPaid Reis, informationPaidLoanPerformance: Mortgage Risk IntelligenceMortgage databasePaidNational Association of Homebuilders Housing DataFree Fitch ratingsRatings for finance markets and businessesPaidNational Association of Real Estate Investment TrustsInvestment dataFree What’s Next? NAR and RESO constantly offer new technologies and protocols to help the real estate industry to coordinate more in terms of data and support. MLS have also begun trying new systems such as reciprocal data exchange and nology pushes the real estate industry to new you need to learn more about real estate technology or update yourself on this subject, we have a great collection of articles that can be accessed through the following link. Enjoy reading, and make sure you submit your questions in the comments section below the Estate Technology

Real Estate Data: Best Databases & Providers 2021 | Datarade

The Ultimate Guide to Real Estate Data

In the US alone, the real estate industry contributed $2. 7 trillion to the country’s economy in 2018 – and in 2020, that figure is only going to increase, with some predicting the construction of 37 ‘megacities’ by 2025. As such, it comes as no surprise that real estate is an industry of universal importance.

To get the best deal when it comes to buying, trading and investing in real estate, it’s essential to have a strong, data-driven strategy. That’s why real estate data is becoming a staple for real estate agents, investors, buyers and sellers.

What is real estate data?

Real estate data gives you information about properties, their purpose, their value, and their ownership. It’s most used by data-driven real estate investors so that they can make informed decisions about where to invest their money most wisely, based on real-time property values.

(Click image to enlarge)

But it’s not just investors who are making use of this lucrative tool: real estate data is handy for owners, renters and businesses – in short, anyone who is involved with buying and selling properties. And by ‘properties’, we don’t just mean homes and buildings. In fact, real estate data can be divided into the following four categories:

Residential real estate data

Data about areas that are designed for people to live in e. g. family homes, apartments, flats, lofts

Commercial real estate data

Data about properties which are designed to generate income for the owner e. shopping centres, hotels, offices

Industrial real estate data

Data about areas and buildings designed for company use, to research, design, produce and distribute physical goods e. warehouses, production facilities, logistical centres, laboratories

Land data

Data about ranches, farms and vacant land. Real estate investors buy vacant land with the view of the land being used for residential purposes in the future, which multiplies the value of the estate significantly.

So, whichever type of real estate you’re interested in, there’s data out there for you. Now let’s look at the attributes of this real estate data in closer detail.

What are the attributes of real estate data?

Residential and commercial real estate data can be categorized into three attributes: land and ownership data, real estate listing data, and real estate demographic data:

Land and ownership data

Land and ownership data is all about the physical characteristics of the property in question. It’ll tell you whether an area of land consists of a home, several homes, farmland, or whether it’s vacant. It’ll also tell you about the property owners – their names, contact details and how long they’ve owned the property for.

Knowing this, you can spot opportunities for real estate ventures, and reach out to the property owners where applicable. For businesses, real estate data can enable real estate agents to find the right investor or buyer for a property. In addition, it can inform marketing strategies, such as identifying a target audience and creating campaigns appropriate for this audience.

There are a number of factors which real estate data providers consider when compiling a land and ownership database. These include:

Geolocation data – Where the property is situated. The information can be presented in the form of an address, or through coordinates.

Site or building coverage – The percentage of the lot area that is covered by the building area, which includes the total horizontal area when viewed in plan.

Plot density – A calculation which expresses the number of dwelling units per acre based on the gross lot area, factoring in thoroughfares, public parks or other public areas. City authorities often refer to plot density to express the minimum and maximum amount of land which is to be devoted to residential purposes.

Site area – The floor area ratio of the site in question. It’s calculated by dividing the total gross building floor area (square feet) by the land area of the lot. In cases where a project site encompasses several buildings on several lots, the floor area ratio may be combined and averaged over the entire project site.

Local authority – The local authority is the city or county in which the property is situated. Some land or assets are owned by federal, state, or local governments as well.

Tenure – Land tenure is the legal term for ‘ownership’: where land is owned by an individual, who is said to ‘hold’ the land. It determines who can use land, for how long, and under what conditions. Tenure can be based both on official laws and policies or on more informal arrangements.

Flood risk – Some properties are at greater risk than others of flooding. When a property is located in a confirmed floodplain, it can have a serious effect on the cost of property ownership, so it’s an important part of land and ownership data.

Property type – The property type refers to whether the property is intended to be used as a house, apartment, industrial facility, or for commercial real estate.

Financing – Property financing refers to the means used by the buyer when the property was purchased, including whether there is an outstanding mortgage.

Taxes – Property taxes are paid on property owned by an individual or corporation depending on the property’s value. It is calculated by the local government where the property is located and paid by the owner of the property.

So, a good real estate database will tell you about land and ownership, providing details about all of these factors.

Real estate listing data

Real estate market data is usually financial data which enables real estate agents, buyers and investors to understand buyer behaviour, investment trends and industry developments. It’s all to do with the transactions which take place in a real estate context.

The following are components of a real estate market database:

Price /sqft – Price per square foot, which includes developments, is a figure which can vary based on location, improvements, updates, and lot sizes.

It doesn’t always provide a fixed, accurate indication of value, but can give you an ‘average’ overview. This average per-square-foot cost of a home can be calculated by adding the square foot cost of each home that’s sold in a given area then dividing that by the number of homes that sold.

Price asked – The asking price is the amount a home seller or commercial real estate owner wants a buyer to pay to purchase their home or property. The asking price is generally part of the property listing and is not the final price paid by the buyer.

Price paid – The paid price is the actual price a buyer pays for a home or property. Part of this sum goes to the real estate agent in the form of commission.

Rent asking – Rent asking is the list price for renting a property, whether it’s an office space or apartment.

Condition of property – Under most jurisdictions, the buyer and the seller have specific rights and obligations regarding the condition of property. The seller is usually required to disclose all aspects of the property which could affect the transaction.

The buyer should be entitled to inspect the property thoroughly before they purchase it, and should be made aware of all the information about its condition provided by the seller.

Days on market – The ‘days on market’ for a rental property refers to how long the listing has been on the market. A good real estate data provider will calculate this independently of the figures given by owners and estate agents, who can try and make it seem as though the property has been on the market for less time than it really has, and use their own counters instead.

Local Housing Allowance (LHA) – LHA was introduced in 2008 by the U. K. government to bring the amount being spent on housing provisions for those renting privately in line with the amount spent on people renting social housing. There are limits on the amount of LHA tenants can get and any shortfall in rent must be met by the claimant.

Public housing – We could think of this as the US equivalent to LHA. The Public Housing (PH) Program was established by the U. S. Housing Act of 1937 to provide decent, safe and sanitary housing for low-income families, elderly, and persons with disabilities.

The U. Department of Housing and Urban Development (HUD) administers Federal aid to local housing agencies (HAs) that manage the housing for low-income residents at rents they can afford. HUD furnishes technical and professional assistance in planning, developing and managing these developments.

HUD sets the lower income limits at 80% and very low-income limits at 50% of the median income for the county or metropolitan area in which the person chooses to live. Rent, referred to as the Total Tenant Payment (TTP) in this program, would be based on the family’s anticipated gross annual income less deductions, if any.

Rent listings – Landlords trying to fill their units and find the best tenants place a listing online, in a publication, or public area.

Sales listings – Property owners trying to sell their real estate for the best price will place a listing online, in a publication, or public area. Typically, the real estate agent will do this for the seller.

Sales history & transactions – Real estate sales history data shows you all transactions relevant for a piece of property derived from recorded sales deeds and loan data.

Yield

Yields are a measurement of expected return on your investment in a property. Potential investors need to consider multiple factors, such as likelihood of finding and retaining a good, long-term tenant, maintenance and infrastructure costs, suitability and location of a property. For data providers, yields are a source of information about how a property’s value rises and falls.

Gross Yield Data – The gross yield is the yield on an investment before the deduction of taxes and expenses. Gross yield data is expressed in percentage terms and is calculated as the annual return on an investment prior to taxes and expenses, divided by the current price of the investment.

Net Yield Data – The net yield is the yield on an investment after the deduction of taxes and expenses. It considers all the fees and expenses associated with owning a property. Thus, it is a far more accurate way of calculating actual yield, but it is also much harder to calculate as most costs are variable.

Real Estate Demographic data

Real estate demographic data focuses mainly on the characteristics of the seller and the area in which the property is situated.

The demographic data attributes can help to determine whether an area is considered affluent or not. For example, a high crime and unemployment rate will affect house prices in that area. Likewise, if an area’s residents fall into a higher tax bracket, it’s likely that properties in that area cost more.

The attributes of real estate demographic data include:

Median income of the area – Information on the average earnings of those living in the area.

The unemployment rate in the area – The percentage of the population in the area who do not have steady employment.

Level of homelessness – An estimate of the amount of homeless people in the area and potential places where they may often be located.

Level of education – The average level of education achieved by those living in the area.

Crime rates in the area – Statistics about all manner of crimes which may or may not occur in the area, and in nearby areas.

The median age of inhabitants – Real estate data regarding the age of inhabitants is beneficial when starting a new enterprise or looking for a home. A family with small children will not want to live in a community intended for senior citizens. Also, a business looking to start a daycare will similarly look for a more demographically appropriate area.

Population size and density in the surrounding area of the property – Population size of the area is always worth considering before a purchase.. A new business will not want to be located in a secluded area and a family looking for the suburban lifestyle probably won’t be interested in a highly populated city.

In-building mobility – In-building mobility refers to tenants that move up within a building to higher and thus more sought-after apartments..

Local amenities – The number of coffee shops, restaurants and supermarkets within a small radius of the property the services they provide can be an important determinant for buying a property. The customer reviews and price points of these amenities are also important bases for both private and commercial real estate decisions.

As we’ve seen, real estate data can give you a whole range of information. It’s an especially diverse data type which is always worth consulting before you make any decision to do with the real estate market. Of course, the data is only as useful as it is accurate, and to ensure accuracy, we need to first understand the methods used by real estate data vendors to gather the facts and figures.

What are the sources and collection methods of real estate data?

Real estate data is collected from both public and commercial records that can be found via municipal, realtor, and broker websites or archives. In fact, much of the real estate data out there resides in non-digital paper files, which reduces the amount of publicly available datasets for transaction purposes.

That’s why the demand for third-party real estate data from an authorized vendor is soaring. Vendors use the following sources to compile their databases:

Physical documents

Paper files about property sales and ownership are usually found at the county courthouse, county recorder, city hall, or another city or county department. These documents include Deeds and Sales reports which tell you about a property’s owners and value. In addition, federal court records can be searched to find out if a seller has filed for bankruptcy or is involved in litigation, shedding further light on the property in question.

Other physical data sources include government statistics providers, company filings from real estate companies, or land registries that provide information about land and ownership data. However, getting the information you need from consulting these files is a lengthy process, and there’s always the risk that the data you’re getting is out of date. By using a real estate data provider, you’ll have access to the data as soon as you need, leaving you the time to make the most cost-efficient real estate decisions.

Online commercial records

Real estate data providers also consult online listings service companies, rental sites, vacation rental platforms or transactional marketplaces that provide transactional real estate data online to consumers and investors, and compile their database from these public advertisement sources.

Data providers have access to aggregators and digital tools which makes this searching process much more efficient than manually trawling the web for information. Similarly, automated searching means that the information you’d get from a real estate data provider is in real-time, which you can’t guarantee when you’re doing the research yourself.

Multiple Listing Service (MLS)

An MLS is a complete database of agent and broker listed homes, specifically used by real estate agents and brokers. Every home for sale that’s listed by a real estate agent will be entered in the MLS unless it’s specifically exempt. Only real estate agents and other professional affiliates can access the MLS; for home buyers and sellers to acquire it, a real estate data vendor is needed.

Home Flipping Reports

Data providers can extract information about property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood by analysing ‘home flipping reports’ – appraisal reports created by real estate agents..

Foreclosure Reports

A foreclosured property is one in which a lender had reclaimed the home or land because of failure to pay by the buyer. They are often sold for prices well under their market value because their owners are eager to unload them. Banks often list their foreclosed properties for sale online.

Prices, photos, and home descriptions are listed along with agents’ contact information. In addition, sites like Fannie Mae and Freddie Mac, which purchase mortgages from banks, often list foreclosures. The Department of Housing and Urban Development lists the foreclosed homes that it owns on its website as well as through local real estate agents, and data vendors compare listings in all of these places to provide foreclosure property information.

Mortgage and Lender Data

Data can be found online for individual loans, the properties and people involved with those loans, and the lending entities involved:

Dates: Loan origination and maturity dates.

Dollars: How much the loan is worth.

Terms: The length of the loaan, specific loan type, and interest rate.

Companies: The lenders of the loan, as well as any other entities involved (for example development or construction companies).

Names: The people behind property ownership—including the names and contact information of the borrowing party.

Assets: The property or properties being mortgaged, as well as any other asset being used as collateral to secure the loan.

However, mortgage data associated with private bank loans is difficult for the public to acquire, as banks are not required to report loan-level detail in the same manner as public entities. This is where third-party vendors come into their own: they’ll give you insights to the real estate market that otherwise would be impossible.

Commercial Tenant Information

For tenant representatives and leasing brokers especially, access to tenant-related information can facilitate stronger prospecting tactics that yield better results for both parties.. Rather than manually sourcing new opportunities and hunting down disparate rent rolls, powerful commercial real estate data providers compile commercial tenant information from various sources.

Tax Records

Property tax records show the amount of taxes assessed on the property. They also show a description of the property’s amenities and give a history of its ownership. Tax records are public records and can be searched on county tax assessor websites or by visiting the tax assessor’s office.

Clearly, the sources available to a real estate vendor are multiple. However, scale doesn’t always indicate quality. This brings us to the next, and most important part, of our guide to buying real estate data: quality assessment.

How to assess and ensure quality for real estate data?

The best way to ensure your investment in real estate data is worthwhile? Ensure that it’s accurate before you purchase. Data quality is an issue when buying from any data provider.

Here are the things you need to look out for to ensure that the information you’re using to create insights is the best it can be:

Consulting multiple sources

When a provider compares information from multiple sources, they’re able to spot gaps, duplicates and anomalies which they wouldn’t see if they relied on a single data source. In an industry like real estate, the market changes regularly as properties are bought and sold every day.

This means it’s more important than ever that your data represents the full market situation. So, always ask your real estate data provider how many sources they use and what these sources are.

Verification procedures

A high-quality data provider will scour their datasets for outliers and remove obvious inaccuracies, as well as typos from real estate agents (which happens more often than you might think! ).

Verification should be automated and regular. Check whether your real estate data provider is verified by independent auditors; always opt for a vendor who has certificates which attest to their impartiality and reliability.

Address standardization

Another specific challenge for real estate data is the standardization of the property address format. Having the same address format in place (country, city, zip code, street, and number) allows users of real estate data to put the data to use more efficiently.

Real estate data needs to be comprehensible if it’s to be useful! Make sure the format your data provider uses is one you’re familiar with.

Integrations

Unless your real estate data can be easily integrated into your existing systems, it’s possible that you’ll end up wasting more time than saving it! Investment firms and real estate developers don’t have the time to manually update data sets.

Moreover, the more stages there are in data interpretation, the more opportunities there are for error. For these reasons, a high-quality real estate data vendor will offer cloud solutions that integrate immediately upon request via real estate data API into the existing systems.

Many data providers also offer ready-to-use SaaS solutions that are used by professionals to manipulate and dissect the data in all sorts of ways.

What are the use cases for real estate data?

As we’ve seen, real estate data can be an asset whether you’re buying, selling or investing in property and land. It’s an especially versatile data type.

Here’s some of the use cases which can inform your decisions and optimize your spending:

Predictive analytics

In real estate, companies can analyze the total condition of the building, its age, how solid it is, all reconstructions that were made before, and information about the current owner to get a correct property estimation. As reported by McKinsey &

Company, machine learning was recently used to forecast the three-year rent per square foot for multifamily buildings in Seattle with an accuracy rate that exceeded 90 percent.

Increased industry transparency

Real estate data provides transparency in business processes. As a result, real estate companies can make all important decisions faster since they are provided with accurate data that is maximally objective in the current period without the fear of fraud.

Real time monitoring and communication

Agents can contact potential buyers at the right time when people are going to buy or sell real property. In turn, agents can also monitor all trends and actual prices because real estate data provides them with an opportunity to offer clients more profitable variants.

Customised strategization

Utilizing real estate data, real estate insurance companies know in advance what insurance type people need in their region allowing them to create custom plans for each region.

These use cases aside, real estate data, like all data types, comes with its own set of challenges. Here is what you should look out for when investing in a third-party dataset.

What are the challenges with real estate data?

It’s possible for real estate providers to struggle with a few challenges in terms of collecting, using, and ensuring the quality of data.

First, since most real estate data is extracted from MLS and other third-party sources, there is the possibility of a lack of standardization. This may result in duplicate listings. As a result, it takes a lot of time and effort to clean and reformat the data.

This is where a third-party data provider must be able to ensure the quality of real estate data and explain their process for cleaning and reformatting to achieve the best quality – if they can’t do this adequately, think about looking at other providers.

In addition, real estate listings are often unverified.

As a result, the data extracted from these listings may be unreliable, requiring a third-party data provider to be able to sift through and verify listings in real-time. This is important as real-time sales and developments can lead to false or inaccurate data if not taken into consideration.

So, again, check that your provider rigorously checks their real estate data sources.

If they arise, these challenges can cause costly delays, wasted time for both the real estate agent and buyer, and the possibility of missed opportunities. Thus, relying on poor quality data may expose buyers and sellers to unnecessary risk, leave them unprepared for sudden changes in rates and prices, and hold them back from reaching their full potential.

To overcome these challenges, always look for data samples- and follow the quality assessment checks we discussed above.

Once you’ve considered all of these factors, the final step towards investing in a real estate database is to come to a pricing arrangement with your vendor.

How is real estate data priced?

Real estate data providers provide data either through software packages or bulk downloads. In addition, there are subscriptions or pay as you go plans. Real estate data that has been aggregated, cleaned, and polished is widely available but like any commercial product some options are more cost effective or higher quality than others.

Traditionally, data has been sold in bulk, but this is time consuming for those that must sift through it and it is not always up to date with the fast-changing real estate industry. Some vendors provide access to the data via a server on request through a software package or subscription. These costs vary depending on the breadth and depth of data requested.

Conclusion

Real estate data includes the collection of mortgage, consumer, and specialized business data to make timely and insightful decisions. Utilizing real estate data, developers can better gauge potential projects, agents more efficiently serve clients, and provide an experience free of clutter and redundancy.

Data can not only make the process run more smoothly, it can also boost real estate profits and reduce development costs. Take a look at the popular real estate data providers to see what their products could do for you.

Who are the best Real Estate Data providers?

Finding the right Real Estate Data provider for you really depends on your unique use case and data requirements, including budget and geographical coverage. Popular Real Estate Data providers that you might want to buy Real Estate Data from are Blue Mail Media, X-Byte, TovoData, ScaleCampaign, and Reomnify.

Where can I buy Real Estate Data?

Data providers and vendors listed on Datarade sell Real Estate Data products and samples. Popular Real Estate Data products and datasets available on our platform are Real Estate Data | Property Data | Real Estate Market Data by GBSN Research, Real Estate Data – Real Estate Agents, Brokers, Investors | 900K+ Verified Real Estate Records by Blue Mail Media, and X-Byte | Real Estate Market data global and API’s from public sources by X-Byte.

How can I get Real Estate Data?

You can get Real Estate Data via a range of delivery methods – the right one for you depends on your use case. For example, historical Real Estate Data is usually available to download in bulk and delivered using an S3 bucket. On the other hand, if your use case is time-critical, you can buy real-time Real Estate Data APIs, feeds and streams to download the most up-to-date intelligence.

What are similar data types to Real Estate Data?

Real Estate Data is similar to Environmental Data, B2B Data, Energy Data, Geospatial Data, and Commerce Data. These data categories are commonly used for Real Estate and Property Valuation.

What are the most common use cases for Real Estate Data?

The top use cases for Real Estate Data are Real Estate, Property Valuation, and Real Estate Analytics.

Frequently Asked Questions about real estate data

Where can I find real estate data?

What Are the Best Public Sources of Real Estate Data?ResourceType of DataAccessUS EPA Environmental InformationEnvironmental, mapping, bidding dataPaidCity-Data.comDemographicsFreeNeighborhoods.REALTOR.comNeighborhood dataFreeUS CensusDemographics, business, revenue, etcFree13 more rows•May 23, 2020

What is real estate data?

What is real estate data? Real estate data gives you information about properties, their purpose, their value, and their ownership. It’s most used by data-driven real estate investors so that they can make informed decisions about where to invest their money most wisely, based on real-time property values.

Who has the best real estate data?

Best Overall Zillow Founded in 2006 by two former Microsoft executives, Zillow offers the most robust suite of tools for buyers, sellers, landlords, renters, agents, and other home professionals. Zillows power and flexibility make it the best overall real estate website in our review.