Bitcoin Proxy

What You Need To Know About Getting A Bitcoin Proxy

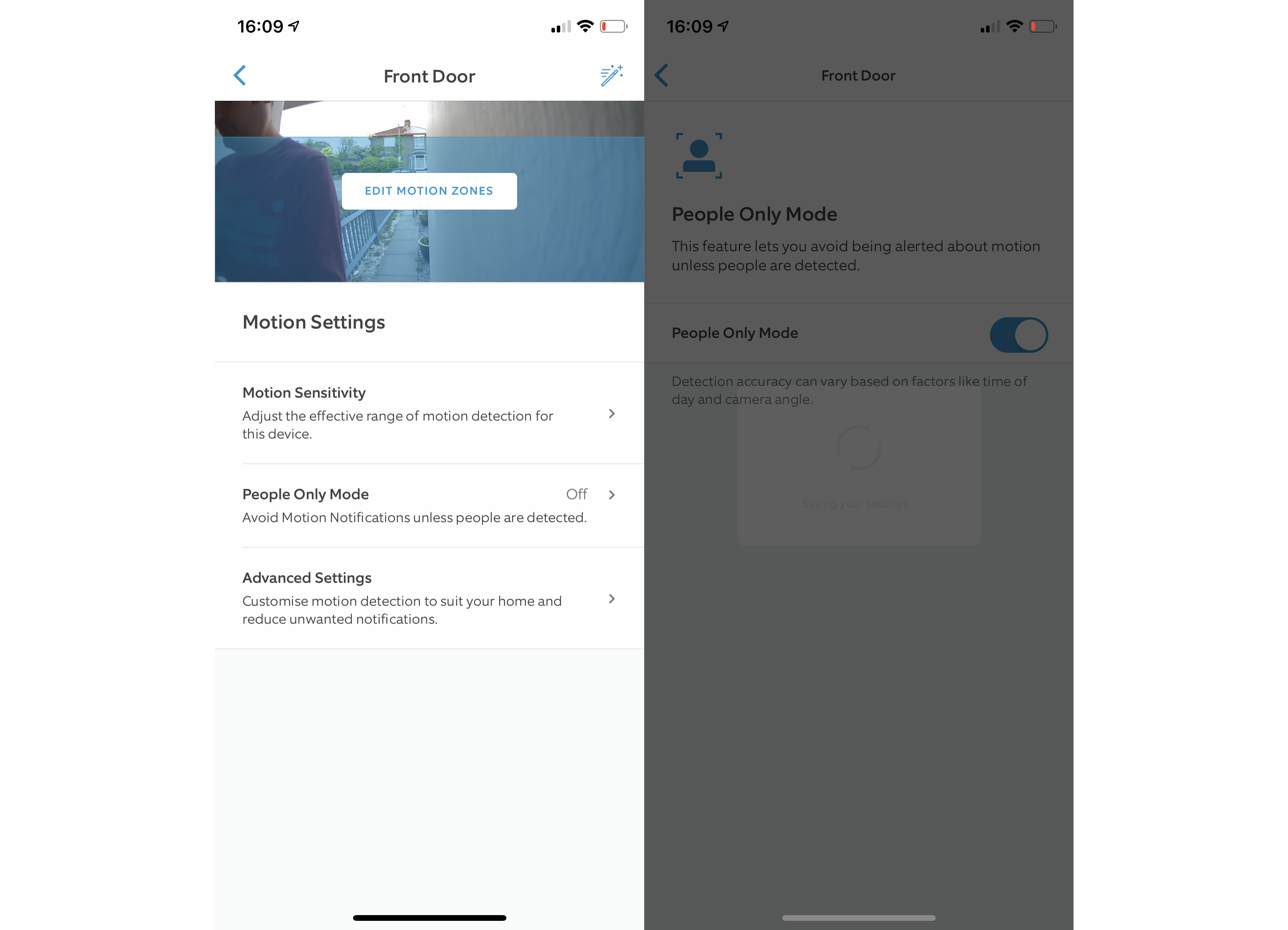

Bitcoins are secretive by their very nature. The digital currency utilizes encryption techniques, making it untraceable. That’s why you can’t know how many Bitcoins someone has. This currency isn’t regulated by a central banking authority, making it a popular choice for people who crave anonymity. Speaking of anonymity, it is likely that you have asked to question, “should I use a proxy when mining Bitcoin? ” Many people like to take it a step further by using a Bitcoin proxy. The proxy gives them a second layer of protection. In some cases, it provides them with some additional features they can use when gathering Bitcoins. Whether you just need to protect your identity or you need help gathering Bitcoins, a proxy is the way to go. But first, you need to know how to set up a proxy for Bitcoin mining. Check out some of the best ways you can use proxies to get Bitcoins by using the table of contents below. Then, start gathering the digital of Contents1. Performing Mundane Tasks for Bitcoins2. Mining With a Bitcoin Proxy3. More Tips for Using Bitcoin Proxies4. Be Smart When Choosing ProxiesPerforming Mundane Tasks for Bitcoins If you have some spare time on your hands, you can perform some mundane tasks for Bitcoins. It’s important that you use proxies for Bitcoin tasks since the site that hosts the tasks can track you without a Bitcoin proxy. The Bitcoins might be untraceable, but you aren’t. If you don’t want the site to track your activity, hide behind a Bitcoin proxy. It’s the best way to stay completely anonymous. Completing mundane tasks for Bitcoins relatively simple process. You can go to Google and type “perform tasks for Bitcoins, ” or you can go to one of the top sites for this and get started. Right now, Coin Tasker is a top site for working for Bitcoins. It has over 37, 000 members and counting, and it offers over 1 million microtasks. You can easily jump from one task to the next on this site. You receive Bitcoins for every task that you complete. The tasks are really simple. You receive Bitcoins for watching videos, completing surveys, playing games, making comments, downloading apps, and more. The site also awards Bitcoins for referrals, so be sure to tell your friends about the service, as well. That will give them the chance to earn some Bitcoins, and you can pad your virtual wallet. That’s a win-win situation for you and your friends. Keep in mind that you aren’t going to get rich with Bitcoins off a site like this. You aren’t going to become a tycoon with Coin Tasker or one of the other sites like this out there. However, it’s nice to get some additional Bitcoin in your wallet. As long as you don’t have anything else going on, you might as well earn a few Bitcoins completing some tasks. It certainly won’t hurt With a Bitcoin Proxy If you want to get more Bitcoins than you can receive with performing mundane tasks, Bitcoin mining might be the right choice for you. This is the process of adding new Bitcoins into the market. While a fiat money system prints new money, the digital Bitcoin currency system adds new money by cracking codes. Referred to as mining, you can get a lot of Bitcoin if you do this successfully. However, it is hard work, and it isn’t for everyone. Check out the process to see if this system is for Mining WorksIn case you aren’t familiar with Bitcoin mining, let’s take a closer look at this. Someone has to keep track of all of the Bitcoin transactions. This is true even though the transactions are confidential. There’s still a ledger. Your name might not be on the ledger, but the number of Bitcoins in the world is on that ledger, and the ledger contains transaction numbers. The Bitcoin network collects transactions and puts them into blocks. The ledger consists of one block after the next. When the blocks are connected, they form a blockchain. Bitcoin miners confirm the transactions and placed them into the general ledger. Blocks have to be confirmed before they become a part of the blockchain. Miners don’t just look over the information and decide that it looks good. Instead, they have to apply a mathematical formula to solve the block and create a hash. Miners compete with each other to solve the formula, and the one who wins is awarded Bitcoins. Bitcoin mining is incredibly competitive and difficult. You can’t just solve the formula on your own so if you want to be a part of this, you need to have the right tools. First, of course, you need Bitcoin proxies. Then, you need the right HardwareYou can’t use your standard PC and expect to win at mining Bitcoin. You need a high-performance PC to mine Bitcoin. Many people go with custom Bitcoin ASIC chips for their computers. Others set up entire warehouses of servers. Bitcoin mining can be quite an PoolsIf you have a supercomputer but don’t have an entire warehouse of servers, consider joining a Bitcoin mining pool. Pools allow you pool your resources with other miners. Then, if your team breaks the code, you split the Bitcoins among everyone. The only rule is you have to show proof that you worked on solving the puzzle. Your chances of earning Bitcoins from mining improve greatly if you join a pool. Sure, you won’t make as much if you break a code, but there is a much better chance that you will break a code or two. There are tons of options for pools out there. Check out Slush Pool and BTCC to name a couple. Keep in mind that you do need a powerful computer for this to work, though. If you don’t have one at home, consider a virtual private server. You can use it for mining Bitcoin. Then, you can use your own computer to log in and control the server as needed. Some companies let you build your own server so you can add what you need to mine the Tips for Using Bitcoin Proxies Now that you know how to make some Bitcoins, let’s look at some tips you can follow to make sure you’re getting the most out of your Faucet SitesNow let’s look at the next option for earning Bitcoins. If you want an easy way to get Bitcoins, a faucet site is perfect for you. Faucet websites hand out Bitcoins to visitors. You might have to fill out a CAPTCHA or play a game, so consider pairing your proxy up with a tool to automate the process. Then, you can sit back and relax while the Bitcoins roll into your wallet. There is one catch, though. Some of the faucets only give Bitcoins to people who have empty wallets. This is pretty easy to get around, though. You can transfer your Bitcoins over to a second wallet, and then visit the gift cards to benefit from your proxy for bitcoinDon’t you hate it when someone gives you a gift card to a store that you never visit? You have to act as if you want to shop at Bath and Body Works, even though no one has gone there since 1996. Now, you can exchange your gift cards for Bitcoins. Just load your Bitcoin proxy server settings into your web browser and head over one of the gift card exchange websites. This is an excellent way to earn some Bitcoins. It’s also a great way to finally get something that you want for Christmas and your birthday. All you need is a proxy for or Sell ServicesNow, sites are popping up that let people buy and sell services for Bitcoin with a proxy. Cryptogrind is one such site. Just log in from your Bitcoin proxy server so you can have complete anonymity. Once you’re logged into the system, you can post a job or look for work on the site. Then, you can either pay a freelancer or receive payment for your work with Bitcoins. This is a great way to boost your Bitcoin wallet. You can list all kinds of services on Cryptogrind. You can offer everything from advertising to writing and translation, so don’t be afraid to try to sell your talents on the site. Go ahead and see if you can make some Bitcoins on the site. You might be surprised by how much money you can make. Plus, it uses an escrow service so you don’t have to worry about getting paid. Some freelance sites are frustrating because you never get your money, but that isn’t the case with Cryptogrind. Turn in the work, and you’ll get Your Eye on the MarketIf you’re selling your services, keep an eye on the market. You will get a set number of Bitcoins based on the services you provide. The Bitcoins you receive will be based on a dollar value. The Bitcoin market is rather volatile, so offer your services when the market is low. That way, you will get more Bitcoins. Then, when the Bitcoins are worth more, the value will rise. That way, you will get more for your money. This is an easy way to increase the value of your Smart When Choosing Proxies This is probably one of the most important tips out there, and it’s typically ignored. People are so careful with their payment options. They choose Bitcoins so they can have an untraceable currency, but then they make the mistake of going with a public proxy instead of a private Bitcoin proxy. Public proxies are often traceable. They simply don’t have the privacy measures in place that you’ll find with private proxies Bitcoin miners need, so they are easily tracked. When you choose a public proxy, you’re sharing an IP address and bandwidth with other people. You’re on the same network, and hackers can easily get into that network and track your location. They might even be able to trace your Bitcoin transactions. On the other hand, when you use a private proxy, you have your own IP address and bandwidth. You don’t have to share your resources with others, so you don’t have to worry about hackers coming in and stealing your information or tracing your Bitcoins. Since you want to stay anonymous when you use Bitcoins, this is crucial. A private Bitcoin proxy has some additional benefits, as well. They are much faster than public proxies are. Whether you are using a faucet site or mining Bitcoins, you need to have speed on your side. You don’t have the time to wait for a proxy to connect to a server. You need to get in, get out, and put your Bitcoins in your wallet. Private proxies Bitcoin miners choose are also much safer. Most people don’t realize this, but public proxies are often operated by hackers. Hackers don’t open these proxies up to be nice. They open them up so they can get your information. Then, once they get your information, they can steal your identity. Don’t make the mistake of handing your information over to hackers. Instead, go with a private Bitcoin proxy. You’ll be much ThoughtsOnce you have your proxies, you can start getting Bitcoins online with your Bitcoin proxy server. With so many options for getting Bitcoins, you should have a wallet full of the coins in no time at all. Then, you can save them or spend them. If you decide to spend them, you have tons of choices at your disposal. You can hire people for services or buy some items online. You can even cash them out. The sky really is the limit, but it all starts with Bitcoins and information contained within this article, including information posted by official staff, guest-submitted material, message board postings, or other third-party material is presented solely for the purposes of education and furtherance of the knowledge of the reader. All trademarks used in this publication are hereby acknowledged as the property of their respective owners. Sign Up for our Mailing ListTo get exclusive deals and more information about a risk-free, money-back guarantee trial today and see the Blazing SEO difference for yourself!

Bitcoin Proxy Stocks Tumble as BTC Tanks – CoinDesk

Stocks of publicly traded companies tied closely to the fate of bitcoin are following the leading cryptocurrency into a sea of red BTC down roughly 20% in the last 24 hours, leading bitcoin proxy stocks have followed suit. MicroStrategy, the business intelligence firm with billions in bitcoin reserves, is down 10% to $435 in the last 24, the owner of Cash App and another holder of bitcoin reserves, is down 3% to $inbase, the leading crypto exchange in the U. S., is down 7% and flirting with all-time lows at $ furniture maker Ethan Allen, the shares of which have benefited from the rise in ether due to the company’s stock ticker being ETH, may now be paying the price for that association today, falling 5% to $bscribe to Crypto Long & Short, our weekly newsletter on signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

Bitcoin ETFs Explained – Investopedia

It seems inevitable that two of the hottest areas of the investment world would meet up sooner or later. For cryptocurrency enthusiasts and investors looking to capitalize on the growing popularity of exchange-traded funds (ETFs), the possibility of an ETF that tracks bitcoin is the best opportunity for this type of connection. However, there have been growing pains and problems in trying to launch the first bitcoin ETFs.

The reason is that bitcoin, the largest cryptocurrency in the world by market capitalization, remains largely unregulated. Additionally, the Securities and Exchange Commission (SEC) is hesitant to allow an ETF focused on the new and largely untested cryptocurrency market to make its way to the public.

Key Takeaways

A bitcoin ETF mimics the price of the digital currency, allowing investors to buy into the ETF without trading bitcoin itself. Investing in a bitcoin ETF cuts out any issues of complex storage and security procedures required of cryptocurrency Securities and Exchange Commission hasn’t approved any digital currency ETFs.

How Does a Bitcoin ETF Work?

Before we look at the potential benefits and risks of a bitcoin ETF, let’s back up a step and go over what a bitcoin ETF is and how it works. An ETF is an investment vehicle that tracks the performance of a particular asset or group of assets. ETFs allow investors to diversify their investments without actually owning the assets themselves.

For individuals looking to focus only on gains and losses, ETFs provide a simpler alternative to buying and selling individual assets. And because many traditional ETFs target larger baskets of names with something in common—a focus on sustainability, for instance, or stocks representing the video game industry and related businesses—they allow investors to easily diversify their holdings.

A bitcoin ETF is one that mimics the price of the most popular digital currency in the world. This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself. Moreover, because holders of the ETF won’t be directly invested in bitcoin itself, they will not have to worry about the complex storage and security procedures required of cryptocurrency investors.

Why Not Just Invest in Bitcoin?

If a bitcoin ETF merely mirrors the price of the cryptocurrency itself, why bother with the middle man? Why not just invest in bitcoin directly? There are several reasons for this. First, as indicated above, investors don’t have to bother with the security procedures associated with holding bitcoin and other cryptocurrencies. Further, there is no need to deal with cryptocurrency exchanges in the process—investors can just buy and sell the ETF through traditional exchanges and markets.

There is another crucial benefit to focusing on a bitcoin ETF rather than on bitcoin itself. Because the ETF is an investment vehicle, investors would be able to short sell shares of the ETF if they believe the price of bitcoin will go down in the future. This is not something that can be done in the traditional cryptocurrency market.

You can short sell bitcoin ETF shares if you believe the price of the underlying asset will go down—an advantage you won’t find by investing in bitcoin itself.

Perhaps most importantly, though, ETFs are much better understood across the investment world than cryptocurrencies, even as digital coins and tokens become increasingly popular. An investor looking to get involved in the digital currency could focus on trading a vehicle they already understand instead of having to learn the ins and outs of something seemingly complicated.

The Road to Bitcoin ETF Approval

Firms looking to launch bitcoin ETFs have run into problems with regulatory agencies. Cameron and Tyler Winklevoss, famous for their involvement in Facebook (FB) and, more recently, for their Gemini digital currency exchange, had their petition to launch a bitcoin ETF called the Winklevoss Bitcoin Trust turned down by the SEC in 2017.

The reason for the denial was that bitcoin is traded on largely unregulated exchanges, leaving it susceptible to fraud and manipulation. The Winklevoss brothers did not give up their efforts. On June 19, 2018, the U. S. Patent and Trademark Office awarded them a patent for a firm called Winklevoss IP LLP for exchange-traded products.

The Winklevosses are not the only cryptocurrency enthusiasts looking to be the first to successfully launch a bitcoin ETF. Cboe Global Markets (CBOE), the exchange responsible for bringing about bitcoin futures, hoped that the SEC will permit digital currency-related ETFs, too. Cboe also acquired Bats Global Markets, the exchange on which the Winklevoss ETF would have been offered.

VanEck and SolidX, a fintech company with projects related to bitcoin, announced plans earlier in 2018 for the VanEck SolidX Bitcoin Trust ETF. This ETF would target institutional investors, according to ETF Trends, as it would open with a share price of $200, 000. XBTC is designed to track an index related to a group of bitcoin trading desks. The idea is that, by spreading out the focus of the ETF somewhat, XBTC may be able to alleviate the SEC’s concerns about funds that are linked to bitcoin itself.

VanEck CEO Jan van Eck explained to CoinDesk that he “believe[s] that collectively we will build something that may be better than other constructs currently making their way through the regulatory process. A properly constructed physically-backed bitcoin ETF will be designed to provide exposure to the price of bitcoin, and an insurance component will help protect shareholders against the operational risks of sourcing and holding bitcoin.

In 2021, there has been much speculation that VanEck and ProShares have recently started withdrawing proposals for Ethereum futures ETFs. This means many to believe that this is a sign for potential Bitcoin futures ETFs on the horizon—fueled by what appears to be the SEC allowing filings to remain active.

The Bottom Line

Although the SEC has so far not approved any digital currency ETFs, investors remain broadly optimistic. A source at the Commodities Futures Trading Commission explained that the chance of a bitcoin ETF being approved in 2018 was “90% at this point. ” The reason for the shift may have something to do with the fact that “the crypto markets have moderated and regulators have watched the lack of drama surrounding bitcoin futures across several global exchanges. 5 In 2021, speculation seems to affirm the 2018 predictions.

The SEC also opened up bitcoin ETF applications to public comments, with the vast majority of commenters voicing their approval for the new product. If and when the first bitcoin ETFs are launched, it’s likely that they will see early success, as both cryptocurrency enthusiasts and traditional investors take part. In turn, the rise of bitcoin ETFs could also help to fuel gains in bitcoin as well, and, because many other digital currencies are closely tied to the performance of bitcoin, gains across the cryptocurrency market.

Ultimately, a source at the SEC explained, “U. residents are sending money to all sorts of exotic locations to invest in unregulated [cryptocurrency] instruments with absolutely zero recourse for losing every cent they’ve put at gulation will begin to solve those issues and keep client assets ‘onshore. ‘”

Frequently Asked Questions about bitcoin proxy

Is there an ETF for Bitcoin?

A bitcoin ETF is one that mimics the price of the most popular digital currency in the world. This allows investors to buy into the ETF without going through the complicated process of trading bitcoin itself.Sep 1, 2021

Is MicroStrategy a Bitcoin proxy?

MicroStrategy owns 105,085 BTC worth around $5.23 billion as Bitcoin’s price returns to $50,000. In fact, the Nasdaq-listed company’s exposure to Bitcoin has made MSTR a quasi-proxy for the flagship cryptocurrency.Sep 2, 2021

Can Bitcoin be blocked?

Bitcoin has already been banned in some countries Currently, just a handful of countries place an outright blanket ban on Bitcoin—and prohibit interacting with, owning, or using the cryptocurrency in any shape or form. These countries include Algeria, Ecuador, Egypt, Nepal, and Pakistan.Sep 14, 2021