Oxy Google Finance

OXY – Occidental Petroleum Corporation – Yahoo Finance

Research that delivers an independent perspective, consistent methodology and actionable insightRelated ResearchOccidental Petroleum CorporatioTechnical Assessment: Bullish in the Intermediate-TermBack on August 25, with West Texas Intermediate (WTI) near $68/barrel, we said it looked like crude had completed a false breakdown, which made it very likely that the correction was over. WTI had hit one of our targets based on a three-wave ABC decline which targeted $62, and that was basically the bottom. Since then, WTI rallied up to the $70 region, paused for about a week, and looks to be breaking out. RatingFair ValueEconomic Moat22 days agoArgus Research

Occidental Petroleum Corporatio (OXY) Stock Price, News …

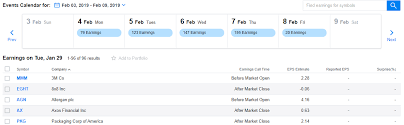

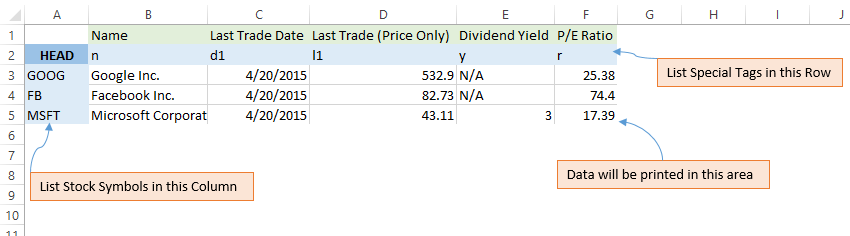

Full screenTrade prices are not sourced from all marketsGain actionable insight from technical analysis on financial instruments, to help optimize your trading strategiesChart EventsBullishpattern detectedCommodity Channel IndexPrevious Close34. 81Open34. 49Bid34. 24 x 900Ask34. 25 x 800Day’s Range34. 21 – 35. 3552 Week Range9. 32 – 35. 75Volume8, 946, 722Avg. Volume17, 032, 733Market Cap32. 032BBeta (5Y Monthly)2. 34PE Ratio (TTM)N/AEPS (TTM)-5. 93Earnings DateNov 04, 2021Forward Dividend & Yield0. 04 (0. 11%)Ex-Dividend DateSep 09, 20211y Target Est39. 92Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have ValueSubscribe to Yahoo Finance Plus to view Fair Value for OXYLearn moreView detailsResearch that delivers an independent perspective, consistent methodology and actionable insightRelated ResearchOccidental Petroleum CorporatioAnalyst Report: Occidental Petroleum CorporationOccidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2020, the company reported net proved reserves of 2. 9 billion barrels of oil equivalent. Net production averaged 1, 306 thousand barrels of oil equivalent per day in 2020 at a ratio of 74% oil and natural gas liquids and 26% natural gas. RatingFair ValueEconomic Moat5 days agoMorningstarView moreZacks5 Top Oil Stock Earnings ChartsEnergy is the best performing sector in the S&P 500 in 2021. With crude over $80, will oil companies see blow out quarters?

Occidental Petroleum Corporation (OXY) Stock Price & News

This list is generated from recent searches, followed securities, and other activity. Learn moreAll data and information is provided “as is” for personal informational purposes only, and is not intended to be financial advice nor is it for trading purposes or investment, tax, legal, accounting or other advice. Google is not an investment adviser nor is it a financial adviser and expresses no view, recommendation or opinion with respect to any of the companies included in this list or any securities issued by those companies. Please consult your broker or financial representative to verify pricing before executing any trades. Learn more