Gumtree Hacked

Gumtree scam, can I be hacked? – PayPal Community

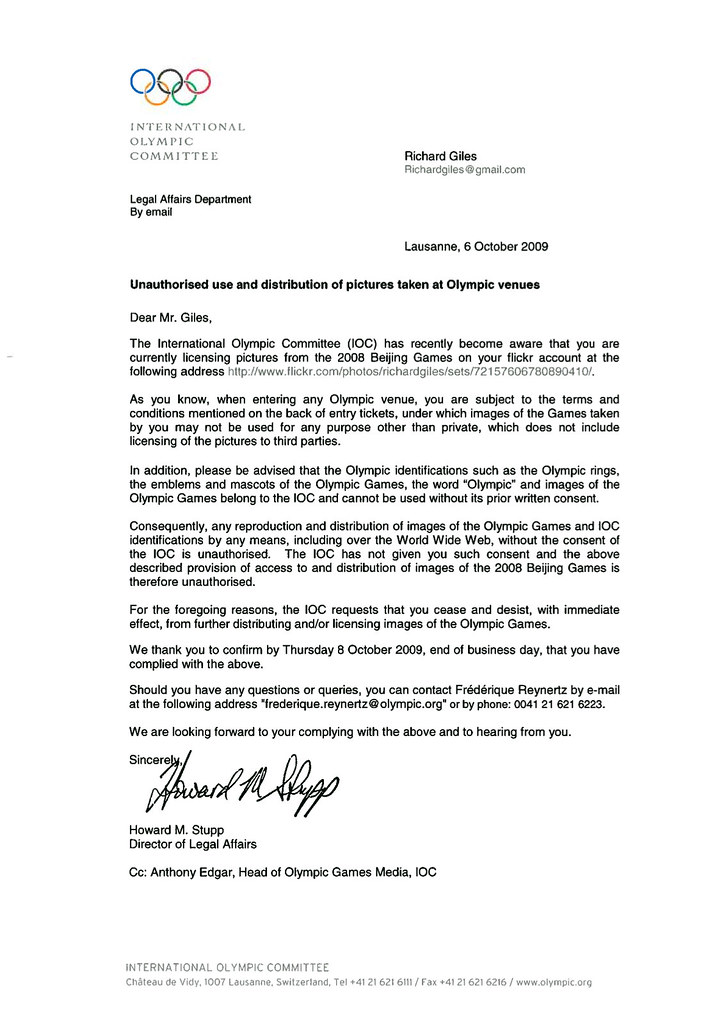

@Kg27It is possible depending on the level of expertise of the person doing it and whether you have great, secure protection on your computer and wifi connection. No way to really tell but the person does sounds sketchy. Keeping the transaction communication through the marketplace is much safer. If you want to go ahead with the transaction, always check your PayPal account to see if the the funds are there, don’t just believe emails as they can be faked. And don’t let them convince you to pay a third party payment processor so PayPal will “release funds”. You’re the seller, you’re supposed to get paid, not pay.

Kudos & Solved are greatly appreciated.

Gumtree website hacked with users personal information stolen

Gumtree users have email addresses and phone numbers stolen by hackers and are warned they could now be victims of identity theftGumtree has sent an email notifying users of a security breachHackers accessed email addresses, names and phone numbersUsers have been warned to be wary of suspicious emails asking for details Published: 03:22 EDT, 29 April 2016 | Updated: 07:31 EDT, 29 April 2016

Gumtree users could be exposed to identity theft and phishing after personal details were exposed during a security breach last were notified via email on Friday that names, email addresses and phone numbers were taken from the have now been advised to be wary of any potential spam emails they may receive that try to coax them into providing personal details or bank details. Gumtree said the hack occurred last weekend and the attackers had access to email addresses, names and numbersLuckily passwords were not accessed but if hackers combined and collected user details, users could be a target for identify theft. The Age reported that an email to affected users indicated the problem was quickly resolved. ‘We resolved the isolated attack within minutes of discovering it and since then we’ve taken extra steps to protect your information, ‘ the email even a few minutes of access to private details could prove dangerous for users. Users have been warned to be wary of any emails they may receive asking them to give personal details’The attackers accessed your email address. Contact names and phone numbers, which are made publicly available on the site if provided, were also accessed, ‘ the email the website used to buy and sell products, transactions are arranged directly between the two parties meaning financial details were not leaked. Users do have access to one another names and numbers if they wish to supply them but they’re only accessible if you’re logged in.

Advertisement

What to do if your bank account is hacked | finder.com

Cyber attacks on banks happen all too frequently. Thankfully, most banks are well protected against hackers, and the threat of a cyber attack shouldn’t deter you from using a financial should your hard-earned money be compromised, here’s how to regain control of your you believe your account has been hacked, there are a few important steps you should take:1. View and verify account activity. First, go through your account activity to confirm any fraudulent charges. Some legitimate transactions may seem fraudulent if the company does business under a different name. 2. Call your bank. Once you’ve confirmed that your account has been hacked, call your bank to report the fraud. They can help you solve the issue and possibly return funds to your account. 3. Freeze your account. If possible, freeze your bank account online, on the app or by speaking with customer service. 4. Change your pins and passwords. Change your bank account pin to something entirely different and secure. Also, consider changing the passwords to your online banking account, email and other online accounts — and try not to use the same password. 5. Check your credit history. If your bank account is hacked, it’s possible that the hacker tried to open a credit card in your name. Speak with your bank to find out if they can check your credit history for free. 6. File a police report. Finally, consider filing a police report. It’s unlikely that you’ll have any information on the person who hacked you, but reports from multiple victims could increase the chances of the thief being caught. If caught, they could face fines up to $1 million or go to prison for up to 30 to do if you don’t agree with your bank’s fraud resolutionIn most cases, you won’t be liable for funds lost due to hacking and fraud. However, if you don’t agree with your bank’s fraud resolution, here’s what you can do:Keep a record of all communications with your bankSpeak with the fraud department directlyEscalate your case to a manager or supervisorFile a complaint with the Consumer Financial Protection BureauIf all else fails, you can consider taking legal actionKeep a close eye on these warning signs that your account could be compromised:Strange purchases. Seeing activity that’s out of the ordinary may be the first clue that a hacker has infiltrated your account. Watch for transactions made in locations where you haven’t been. Unfamiliar transactions. Sometimes you’ll notice small yet unfamiliar purchases. Thieves often do that to test if your card will work before making larger ones. Blocked login. If a hacker accesses your account from an unfamiliar location or tries your password too many times, your account may block you from logging call from your bank. If your account is compromised, your bank may call to notify you of the recent breach. However, it’s essential that you don’t provide the caller with any personal or emptied account. In more extreme cases, you may find that your bank account has been emptied or closed card. If your account is compromised, your account could be emptied or your card could be frozen by your bank, leading to denied pending on your bank, it will notify you of suspicious activity and automatically cancel fraudulent charges and issue you a new safe onlineCheck for site security. Most legitimate sites will have privacy and security terms that you can review. Secure URLs start with — not public networks for banking. That means no quick peeks at your finances while you’re out shopping or working. Using public networks can compromise your personal security and put your information at ’t give your contact info to strangers. Confirm who’s calling or writing first before providing any antivirus and anti-malware software. Doing so could prevent computer viruses and the loss of your of spam. Email software is effective at getting rid of spam most of the time. However, hackers design sites that mimic bank websites, so random emails that ask you to go to the bank’s website to confirm your information are most likely a strong passwordsDon’t use the same passwords. Avoid using the same passwords for multiple online accounts. Otherwise, a security breach on one website could compromise all of your your passwords and pins safe. That means not giving them out to anyone, including family, friends or anyone soliciting them over email. Also, try not to write them security questions. The answers to your security questions won’t be verified, so you can choose any answer you’d like. Consider making the questions difficult or the answers harder to authentication. If possible, sign up for two-factor authentication. This security measure will require you to confirm your identity with your phone or email, decreasing the chances of unauthorized more characters — and symbols — in your password. The more characters in your password, the better. A mix of random letters, numbers and special characters will take much longer to crack than a simple word or series of vigilantReport suspicious activity. Report any suspicious people or unverifiable companies soliciting your banking information. You may also want to contact your your transactions. Look over your statements for any fraudulent purchases and report anything suspicious right an eye on your credit history. If someone gets access to your bank account, they could sign up for credit cards and other financial products that would affect your credit. Check your credit history if you think your account is at up for text alerts. Apps and text alerts can send you a notification whenever your debit card is used. This can help you track spending and immediately know where and when your card is can hackers steal your credit card CVV number? Types of bank account hacking and fraudKnowing the weak spots that hackers look for and the tricks they use can go a long way in protecting you from cyber theft:Weak passwords. Using simple, easy to guess passwords can put your accounts at audulent texts and phone calls. Beware of any emails or phone calls from numbers claiming to be your bank. They might just be looking to steal your information to access your ishing links. Watch out for unfamiliar links in emails or while browsing online. While they might look legitimate, these links and websites are designed to look official to trick you into entering your lware. This type of virus can be picked up from sketchy websites and emails, infecting your computer and possibly intercepting your information and Websites and banks affected by security breaches can allow unauthorized people to access your info. It’s essential that you use different passwords for all of your online accounts. Otherwise, a breach on one website could affect all of your online Wi-Fi. Avoid logging into your bank account on public Wi-Fi, as hackers could use the public connection to intercept your information and access your engineering. Some hackers will go the extra mile to access your information by calling your bank and impersonating you. And since most banks will use your personal information to verify your identity, it’s important to not give your personal information to scanners. These devices — when placed over an existing, legitimate card scanner — will take a picture of your card and could record your pin. When using an ATM in an unfamiliar location, wiggle the card socket to check for a fraudulent card mpare these nine bank accounts to see what fraud protections they come with. Banks are liableIf a hacker steals money from a bank, the customer won’t lose money since the bank is liable to refund money for fraudulent debit transactions. However, it’s important to report fraud as soon as possible, as the bank’s liability decreases over you report a lost or stolen card immediately and before it’s used, you can’t be held liable for any charges. If you report a charge within 48 hours, you could be responsible for up to $50, or up to $500 if you wait longer than two days. Beyond 60 days, your bank is no longer responsible for the lost funds and you might be out any money that was are improving securitySince banks are constantly under attack, they need to ensure every aspect of their security is up to date. This means they generally have the latest software designed to protect you and your your account is not vulnerableMost banking websites allow you to activate a feature called “remember your password” when you log in online. This allows you to skip several layers of security the next time you log in since the bank recognizes your computer’s IPv4 address — a unique identifier for each Internet ever, malware is a tool that hackers use to imitate your IPv4 address in order to gain access to your bank account. And since you usually won’t know that they have control over your computer, it’s best to disable the “remember your computer” guide to finding a bank account that meets your needsAs stressful as having your bank account hacked may be, there’s a chance you could get your money back if you act fast. Banks are generally responsible for any charges due to cybersecurity breaches, but you should still always be are a number of things you can do to reduce the chances of your bank account being hacked, and choosing the right bank is one of them. Compare your options to find a bank and account that meet your needs.

Peter Carleton is a writer that covers banking and investing, breaking down what you need to know about where you put your money. When Peter’s not thinking about cutting-edge banking apps and robo-advisors, he runs a creative agency and spends his spare time cooking or reading.

More guides on Finder

How to buy Bitcoin (BTC) in the US

Want to buy bitcoin but don’t know where to start? This comprehensive guide provides step-by-step instructions on how and where to buy BTC in the US.

Douugh banking review

The Douugh banking app uses AI to optimize your finances, but it lacks key features.

Coronavirus: Common scams to watch out for

Details on the most common scams to avoid during the coronavirus health crisis, plus tips for keeping your information safe online.

Frequently Asked Questions about gumtree hacked

Can you get hacked on Gumtree?

Gumtree users could be exposed to identity theft and phishing after personal details were exposed during a security breach last weekend. … Luckily passwords were not accessed but if hackers combined and collected user details, users could be a target for identify theft.Apr 29, 2016

Can you get hacked money back?

If a hacker steals money from a bank, the customer won’t lose money since the bank is liable to refund money for fraudulent debit transactions. … Beyond 60 days, your bank is no longer responsible for the lost funds and you might be out any money that was stolen.

Can you report a hacked account?

Visit Report Compromised Account page >> Select “My Account Is Compromised” option >> Enter your email ID or phone number linked to your account. The page displays a list of options. Select your reasons and follow the instructions.