Alternative Data Companies

Top 10 Alternative Data Providers and APIs – Datarade

Alternative data can mean essentially anything. Whether we talk about data collected from satellite imagery, scraped website data, or information collected upon point of sales, they all have one thing in common; hedge funds, asset managers and financial insitutions love them.

Why?

Alternative data is mainly used during financial analysts to predict a stock’s performance more accurately. Quality predictions can give an investor a competitive edge over others, thus being able to beat the average market returns. This difference is called the alpha.

With strong evidence of data’s power in financial analysis, there is a rising number of market research companies using cutting-edge technologies that provide a variety of alternative data for different markets.

How do you as an investor make sure that you’re talking to a provider who can take your decisions to the next level?

While there are many criteria to data quality which are often determined by your specific use case, there are a few companies which stand above the others.

We compiled a list of the top 10 alternative data companies on our platform. The list is here to help you get started in your search for alpha.

With over 700, 000 public and private companies in their database, Thinknum enables strategists to create investment ideas rooted in alternative data. The company’s time specific data series helps both research firms and institutional investors in issues from alpha generation to risk mitigation. Thinknum indexes all of their real-time data trails using proprietary machine-learning techniques in order to offer directly actionable insights.

Quexopa is the leading alternative data provider for the South American markets. Headquartered in Panama, the company brings Latin American transaction insights into the fingertips of financial institutions and governments. In Mexico alone, Quexopa, covers over 250, 000 accounts with over 5 million monthly transactions.

Yewno has its focus on creating a fully comprehensive knowledge graph for hedge funds and asset managers. The company collects information from events and the public data which is then put into their artificial intelligence to enable financial professionals with actionable insights on topics like ESG, Patent Analytics, distinct alpa signals and many more.

Providing low latency quality information and investment signals, Infotrie’s API gives financial leaders new routes to investment strategies and alpha generation. As an alternative data and fintech specialist the company has data on over 50, 000 stocks in global markets, covering the US, Europe, Asia, Australia, and even South America.

Based in the US, Caretta provides alternative data for clients who are looking to screen for crowded stocks, manage risks, and benchmark their investor performance against others. Their wide coverage of collected, and analyzed long/short ownership data is derived by using state-of-the-art technology.

By building a bridge between new technology and timely macro strategy Exante Data has enabled an extraction of price signals from detailed capital flow analysis. Offering more than 10, 000 data series for more than 30 countries globally the company complements hard data and raw model outputs with timely, narrative-based content, focusing on key global thematics and risk scenarios.

With more than 19, 000 news and social media sources RavenPack Analytics is one of the leading alternative data providers for alpha generation and risk management. With the company’s offering, hedge funds can gain access to analytics based on content across the last 20 years. All of their analytics are produced on entity basis and include scores for relevance, and sentiment.

Brain is a data research company providing alternative datasets through Natural Language Processing (NLP) and machine learning (ML) infrastructures. The company has used these technologies to create a sentiment indicator which measures the “mood” of about 8500 global stocks. Selling these proprietary signals makes BRAIN an interesting player in the Alternative Data ecosystem.

Suburbia provides alternative insights by gathering point-of-sale transactions from scalable sources across geographies. Founded in 2018 and headquartered in Netherlands, Suburbia partners with other companies in the payments ecosystem in order to capture evn cash payments – which are still a big portion of the general trade in many european economies like Germany.

With their web-scraped data from over 1 billion websites, Accern has enabled intelligent decision making for some of the most prestigious financial services firms in the world. The company’s solutions influence 100+ billion in AUM every single year. By scraping public news/blog websites Accern produces actionable financial information while maintaining strict policy in their data quality.

Alternative data (finance) – Wikipedia

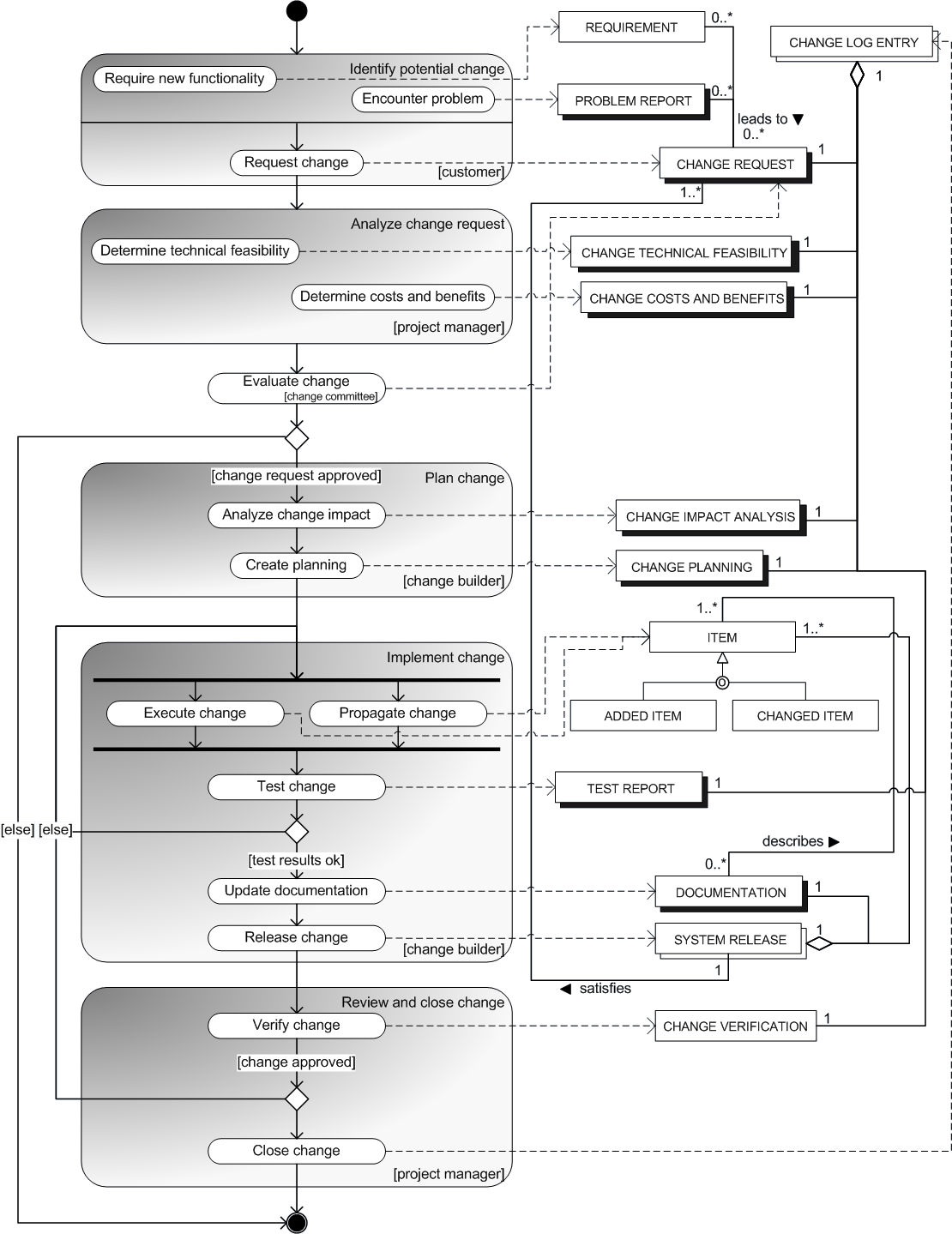

Alternative data (in finance) refers to data used to obtain insight into the investment process. [1][2] These data sets are often used by hedge fund managers and other institutional investment professionals within an investment company. [3][4][5] Alternative data sets are information about a particular company that is published by sources outside of the company, which can provide unique and timely insights into investment opportunities. [3][6][7]

Alternative data sets are often categorized as big data, [8] which means that they may be very large and complex and often cannot be handled by software traditionally used for storing or handling data, such as Microsoft Excel. An alternative data set can be compiled from various sources such as financial transactions, sensors, mobile devices, satellites, public records, and the internet. [3][6][9][10][11] Alternative data can be compared with data that is traditionally used by investment companies such as investor presentations, SEC filings, and press releases. [6][12] These examples of “traditional data” are produced directly by the company itself.

Since alternative data sets originate as a product of a company’s operations, these data sets are often less readily accessible and less structured than traditional sources of data. [3][13] Alternative data is also known as “exhaust data. ”[14] The company that produces alternative data generally overlooks the value of the data to institutional investors. During the last decade, many data brokers, aggregators, and other intermediaries began specializing in providing alternative data to investors and analysts. [15][16]

Types[edit]

Examples of alternative data include:

Geolocation (foot traffic)

Credit card transactions

Email receipts

Point-of-sale transactions

Web site usage

Mobile App or App Store analytics

Obscure city hall records

Satellite images

Social media posts[17][18]

Online browsing activity

Shipping container receipts

Product reviews

Price trackers

Shipping trackers

Internet activity and quality data

Example of sentiment analysis against stock price (S&P 500)

Uses[edit]

Alternative data is being used by fundamental and quantitative institutional investors to create innovative sources of alpha. The field is still in the early phases of development, yet depending on the resources and risk tolerance of a fund, multiple approaches abound to participate in this new paradigm. [19][20]

The process to extract benefits from alternative data can be extremely challenging. The analytics, systems, and technologies for processing such data are relatively new and most institutional investors do not have capabilities to integrate alternative data into their investment decision process. [21] However, with the right tools and strategy, a fund can mitigate costs while creating an enduring competitive advantage. [19]

Most alternative data research projects are lengthy and resource intensive; therefore, due-diligence is required before working with a data set. The due-diligence should include an approval from the compliance team, validation of processes that create and deliver this data set, and identification of investment insights that can be additive to the investment process. [19][22]

However, the usage of the alternative data is not restricted by investment sphere, it’s successfully used in economics and politics as well as retail and e-commerce spheres. It’s possible to predict geopolitical risk through a profound alternative data analysis, while social media sites reveal a host of data for consumer sentiment analysis.

Methodology[edit]

Alternative data can be accessed via:

Web scraping (or web Harvesting, performed by computer programmers that design an algorithm that searches websites for specific data on a desired topic)[23]

Acquisition of Raw data

Third-party Licensing

Analysis[edit]

In finance, Alternative data is often analysed in the following ways:

Scarcity: the data Information overload within financial markets

Granularity: the level of detail and aggregation of data (including time)

History: the trajectory of data

Structure: the form of the data (csv, json etc. )

Coverage: the stocks or geographical locations that data can be linked with

Best practices[edit]

While compliance and internal regulation are widely practiced in the alternative data field, there exists a need for an industry-wide best practices standard. Such a standard should address personally identifiable information (PII) obfuscation and access scheme requirements among other issues. Compliance professionals and decision makers can benefit from proactively creating internal guidelines for data operations. Publications such as NIST 800-122[24] provide guidelines for protecting PII and are useful when developing internal best practices. Investment Data Standards Organization (IDSO) was established to develop, maintain, and promote industry-wide standards and best practices for the Alternative Data industry.

Web Scraping[edit]

Legal aspects surrounding web scraping of alternative data have yet to be defined. Current best practices address the following issues when determining legal compliance of web crawling operations:

Review of the terms and conditions associated with the websites crawled

Control over the potential interference with crawled websites

Web scraped data refers to data harvested from public websites. With 4 billion webpages and 1. 2 million terabytes of data on the internet, there is a mountain of information that can be valuable to investors when analyzing a corporate performance.

The companies that specialize in this type of data collection, like Thinknum Alternative Data, [25][26][27] write programs that access targeted websites and collect and store the scraped information on a periodic basis. In some cases web scraping requires use of public APIs as a way to access the data within those pages directly without visiting the actual website.

Types of web scraped data include:

Job listings: A company that is increasing hiring and headcount is likely experiencing growth.

Company ratings: Sites like Glassdoor allows employees to rate their company; increasing ratings, especially (in conjunction with increasing job listings) can be another growth indicator.

Online retail data: High product rankings on online retailers suggest strong sales for those product manufacturers. On the flip side, heavy discounting of products suggest weak sales. [28]

Standards Board for Alternative Investment (SBAI) is the global standard-setting agency for the alternative investment industry and guardian of the Alternative Investment Standards. The agency supported by approximately 200 alternative investment managers and institutional investors and collectively manage $3. 5 trillion. The SBAI has published the Standardised Trial Data License Agreement which addresses investment managers’ issues when comes to new data trailing process, like alternative data and big data. [29] Thomas Deinet, Executive Director of the SBAI said: “This Trial Data Licence Agreement template highlights a number of very important issues, including personal data protection, which has become a hot topic in light of the overhaul of data protection regulation in many jurisdictions. It also includes key protections for managers in areas such as prevention of insider trading and ‘right to use data’. It is crucial that managers and data vendors fully understand all risks when selling and using new data. “[30]

See also[edit]

Fintech

References[edit]

^ Z., W. (2016-08-22). “Why investors want alternative data”. The Economist. Retrieved 21 August 2017.

^ Flanagan, Terry (2016-12-07). “‘Early Days’ For Alternative Data”. Markets Media. Retrieved 21 August 2017.

^ a b c d Kolanovic, Marko; Krishnamachari, Rajesh. “Big Data and AI Strategies – Machine Learning and Alternative Data Approach to Investing”. RavenPack. J. P. Morgan, Global Quantitative & Derivatives Strategy. Archived from the original on July 22, 2018. Retrieved June 29, 2017.

^ Nathan, Krishna (2017-01-03). “What is ‘alternative data’ and how can you use it? “. CIO. Retrieved 20 August 2017.

^ Belissent, Jennifer (2017-06-23). “The Age of Alt: Data Commercialization Brings Alternative Data To Market”. Forrester Research. Forrester Research, Inc. Retrieved 20 August 2017.

^ a b c “Searching for Alpha: Big Data. Navigating New Alternative Datasets”. Eagle Alpha. Citi Research. Retrieved July 3, 2017.

^ Hafez, Peter. “Data Hoarding and Alternative Data In Finance – How to Overcome the Challenges”. RavenPack.

^ Savi, Raffaele; Shen, Jeff; Betts, Brad; MacCartney, Bill. “The Evolution of Active Investing Finding Big Alpha in Big Data” (PDF). BlackRock. Retrieved August 9, 2017.

^ Kilburn, Faye (2017-07-19). “Quants look to image recognition to process alternative data”. Retrieved 21 August 2017.

^ Sapnu, Raquel. “Why Alternative Data is the New Financial Data for Industry Investors”. Datafloq. Retrieved 21 August 2017.

^ Barnes, Dan (2017-07-02). “The role of data in gaining valuable financial insights”. Raconteur. Raconteur Media Ltd. Retrieved 21 August 2017.

^ Turner, Matt. “This is the future of investing, and you probably can’t afford it”. Business Insider. Retrieved 11 August 2017.

^ Iati, Robert. “Alternative Data: The Hidden Source of Alpha” (PDF). Dun & Bradstreet. Retrieved August 9, 2017.

^ Noyes, Katherine (2016-05-13). “5 things you need to know about data exhaust”. Computer World. IDG News. Retrieved 11 August 2017.

^ Levy, Rachael. “Hedge funds are tracking your every move, and ‘it’s the future of investing”. Retrieved 21 August 2017.

^ Wigglesworth, Robin. “Investors mine Big Data for cutting-edge strategies”. Financial Times. Retrieved 21 August 2017.

^ Borzykowski, Bryan (2016-06-09). “How investors are using social media to make money”. Retrieved August 3, 2017.

^ Wieczner, Jen. “How Social Media Is Helping Investors Make Money”. Fortune. Retrieved August 4, 2017.

^ a b c Ekster, Gene. “Driving Investment Performance with Alternative Data”. Integrity Research. Retrieved August 2, 2017.

^ McPartland, Kevin. “Alternative Data for Alpha” (PDF). GREENWICH ASSOCIATES. Retrieved 11 August 2017.

^ Najork, Marc; Heydon, Allan (2002). Handbook of Massive Data Sets. Springer US. pp. 25–45. doi:10. 1007/978-1-4615-0005-6. ISBN 9781461348825.

^ Ekster, Gene (2015-08-19). “Alternative Data Cross-functional Teams and Workflow”. Retrieved August 7, 2017.

^ Ekster, Gene (2016-05-02). “Mitigating Alternative Data Compliance Risks Associated with Web Crawling”. Retrieved June 20, 2017.

^ McCallister, Erika; Grance, Tim; Scarfone, Karen. “National Institute of Standards and Technology Special Publication 800-122: Guide to Protecting the Confidentiality of Personally Identifiable Information (PII)” (PDF). National Institute of Standards and Technology. Retrieved June 25, 2017.

^

^ Johnson, Richard. “Alternative Data in Action: Web-Scraping. ” 14 January 2019

^ “SBAI Publishes Standardised Trial Data License Agreement” 6 February 2019. Retrieved 15 May 2019. [permanent dead link]

^ “SBAI publishes Standardised Trial Data License Agreement. “6 February 2019. Retrieved 15 May 2019.

Further reading[edit]

Alexander Denev and Saeed Amen, The Book of Alternative Data: A Guide for Investors, Traders and Risk Managers (Wiley 2020)

Marko Kolanovic and Rajesh T. Krishnamachari, Big Data & AI Strategies: Machine Learning and Alternative Data Approach to Investing (JP Morgan 2018)

Alternative Data: A Definitive Guide to Alpha-Generating …

Firms are increasingly using alternative data like satellite imagery to inform their investing financial services industry has always used data to inform its investing decisions. After all, data-backed decision making mitigates risk and instills confidence in investors on the part of clients. Until recently, however, firms gathered data through “traditional” data sources like press releases, SEC filings, earnings reports, and credit nology has enabled the development of the ability to ingest, process, and analyze large amounts of data that is both structured and unstructured from new and never before used sources. As a result, firms now have the ability to harness these alternative data insights to use them to inform their investment decisions, make more accurate investments, and ultimately generate you’ll learn in this article:This article explains everything you need to know about alternative data. Specifically, you’ll learn:What is alternative data? How is alternative data generated? Benefits of using alternative dataHow alternative data can be usedAlternative data providersKey requirements of an alternative data programChallenges in implementing an alternative data programArchitecting for alternative dataWhat is alternative data? Alternative data is data that is not generated by “traditional” financial data. It is used in the investment process to inform investing decisions. Taking the form of anything from scraped web content to social media sentiment analysis, to satellite imagery, it can provide unique and timely insights into investment opportunities that investors can’t get from traditional data it worth the hype? Short answer: yes. Spending on this data is expected to surpass $1 billion by 2020. In fact, more than 400 alternative data suppliers exist on the market today, so demand and use will only number of employees dedicated to alternative data full time has grown by 450% in the past five years. In fact, according to a 2018 study, almost 80% of investors turn to such data to inform their investing decisions. Given that investors want access to the most granular insights available to make the best possible investment decisions, it is here to is alternative data generated? Over the past two years alone, we have generated 90% of the data in the world. Technology connects humans and businesses more than ever before. By the year 2022, 29. 5 billion networked devices will exist and 4. 8 billion people will use the internet, according to is no comprehensive list of what this data is. Technology today can track social media, media, sentiment, IoT, geolocation, eCommerce buying habits, airline bookings, retail inventory data, mortgage data, entertainment events data, hotel bookings, satellite images, and s divide alternative data roughly into three categories: data generated by individuals, data generated through business processes, and data generated by dividuals:Individuals generate unstructured data. Coming primarily from web traffic, app usage, and social media, this data is valuable for detecting sentiment and consumer behavior. With 1. 56 billion daily active users on Facebook and 126 million daily active users on Twitter, scraping social media for sentiment and feedback has become commonplace. For example, understanding sentiment helps brands to understand brand performance, reduce churn, and increase lifetime customer Processes:Businesses also generate data in the form of banking records, credit card transaction records, commercial transactions, supply chain data, and government and corporation data. This data is usually structured and is a good overall indicator of business performance. In addition, it is a good predictor of company nsors:Data generated by sensors is the third major source of data. This data comes from satellite images, weather forecasts and predictions, and geolocation data through wifi signals. Data from sensors is usually the largest and is unstructured. Among other things, businesses use sensor data to track foot traffic and detect the health of stores. Benefits of using alternative dataYou know what it is and how it’s generated, but what are the benefits of using this data? Alternative data can save traditional money managers time. By using programs that sift through news and data on their behalf, businesses produce more accurate insights and unbiased decisions. In addition, analysts can get a better signal about what’s going on in the market in real time by using these larger and more dynamic alternative ternative viewpoints and unforeseen insightToday, analysts have access to thousands of data sources. Using this data gives analysts access to different viewpoints that you would not normally have access to when using traditional data sources. As a result, they can generate new investment ideas, discover unforeseen insights, and even predict future market ansparency into company performanceTraditionally, data used by portfolio managers only gave historical insight into company performance. Having to wait for quarterly earnings reports and financial statements meant being reactive with investment strategies. Now, integrating alternative data allows portfolio managers and investors to get real-time signals into company mpetitive edgeUsing alternative data gives you a competitive edge over other firms in your industry. Consequently, leveraging such data means your firm can understand everything it can about a possible deal or investment beforehand. While almost 80% of firms today use some form of alternative data to inform their investment strategy, financial firms can still take advantage of what it has to ternative data in actionFirms can use alternative data in several different ways. Below are just a few examples of how firms have leveraged predictionsA hedge fund wanted to predict which industries would be affected by Brexit. Building bots to scrape data from Bloomberg, Financial Times, and other publications, they looked for “Brexit” and SEC-delineated industries to figure out what was being covered and focused in on specific industries of focus. M&A dealsBy using publicly available flight information, a company used flight data to track the flight patterns of corporate jets. They trained a machine learning model to make predictions about repeated flight patterns for certain companies to predict M&A example, executives from Cisco were flying repeatedly to Carlsbad, CA, where Luxora is headquartered. They later acquired Luxora. HCA Health executives were visiting Asheville, NC often, and they later acquired Mission Health, which is headquartered in Asheville. Testing new ideas and identifying new opportunitiesA leading long/short equity hedge fund created a flexible and scalable alternative data program. Their program continuously and rapidly digests any number, size, or format of data sources, converts unstructured data into machine-readable formats, and incorporates data quality checks. Analysts at the hedge fund now onboard new data in less than one hour. With access to high-powered and quickly integrated alternative data insights through its custom-made data platform, the hedge fund has completely changed how it processes and investigates data. Next-gen insights gathered from alternative data now enhance its investment strategies. As a result, analysts now make better-informed investment decisions. Learn ternative data providersWhat to look for in a provider:When looking for an alternative data provider, it is important to find those that have the data that you need, and enough of it to inform your investing decisions. Other important questions to ask when looking at vendors:Can you integrate the source with your existing system? How much will the data cost? Will the alternative dataset be a good ROI, or will it just add noise to your analysis? How long will it take to integrate the data into your system? Alternative data provider examples:Today, over 400 vendors supply alternative data in the marketplace. This list is not exhaustive, but it highlights some of the top data providers in the market that feature different data sources and Quandl is a data aggregator that leverages relationships to source alternative data from IoT, consumers, natural resources, logistics, B2B, and more to enhances trading strategies for its users. YipitData: YipitData is a data aggregator that sources web data, [anonymized] consumer receipts, and survey data weekly and monthly from over 70 companies across multiple industries and minr: Dataminr scrapes public tweets and turns them into real-time alerts and sentiment analysis to assist its clients across several industries in trading, market awareness, client advisory, and thesis Evidence Lab: UBS Evidence Lab sells insight-ready datasets of quality and vetted data for other financial services firms to integrate with their own data. 1010data: 1010data aggregates credit card data from third-party providersS&P Global Market Intelligence: S&P Global Market Intelligence uses natural language processing to understand sentiment from earnings calls. It has data on 8, 300 companies dating back to Annie: AppAnnie collects mobile app usage data and trends to enable its users to make more informed decisions on consumer Requirements of an Alternative Data PlatformAn effective program needs to do more than just bring in data. Your alternative data platform needs to be able to:continuously ingest any number of raw data sources of any size, volume, or structure, including structured, semi-structured, and unstructured data; large quantities of small data files; large quantities of large data files, etc. rapidly onboard new data sources of any kindenable discovery and hypothesis testing on ingested data in order to create and refine use cased based on a subset of the available dataproductionalize the preparation of newly ingested data towards all established use cases and rapidly deploy new use casesupdate a visualization layer that enables analysis and real-time tracking of use casesChallenges in Implementing an Alternative Data ProgramUsing alternative data to enhance and inform investing decisions might sound great, but establishing and implementing a program comes with unique challenges. When creating one, companies should ensure their data programs are capable of the below points. Onboarding and enabling new data sources with minimal effortIn order to take advantage of the potential of all data, your system needs to be able to onboard and enable new data sources with minimal effort. You’ll want to avoid the need for additional development or code refactoring to accommodate something unforeseen in a new data source that you want to creation of a universal data extraction processFlexibility is key when using any big data. An extraction process has to be capable of extracting all the data points that are contained within a given file format. Relying on a hard-coded schema for each individual data source will lead to problems down the commodating schema shifts in the source dataAccommodating schema shifts in the source data is particularly important with unstructured or self-gathered datasets because you need to be flexible if the data alability and avoidance of bottlenecksYou want to be able to digest and process each individual data source in a timely manner and be able to accomplish this in parallel with different data sources that will be landed at the same time. If your system needs to suddenly ingest a new, large dataset while simultaneously updating datasets already in its arsenal, it will need to be flexible and scalable to avoid bottlenecks and possible ivacy, sensitivity, and confidentialityYour system needs effective data governance in place to be used safely and efficiently. Companies should also keep laws like GDPR and the California Consumer Privacy Act in mind when collecting, ingesting, and using chitecting for alternative data: important considerationsData governanceData governance is essential to ensuring your program is an effective part of your overall enterprise. An effective strategy prevents organizational issues and conflicts resulting from the mismanagement of data. In addition, it allows the appropriate people to access certain levels of the data. Furthermore, you should keep the following best practices in mind:Create an alternative data frameworkAutomate mundane tasksEmbed data cleansing and integrationUse a big data ecosystemEmbrace changeLeverage consultantsSift through the noise and find data that will give your firm an edge over the competitionCaserta’s Alternative Data Supply ChainAt Caserta, our alternative data engagements involve the same process, based on the supply chain. The alternative data supply chain ensures a cohesive and effective, alpha-generating alternative data program is created with maximum First, we identify the business initiatives, plan the alternative data architecture, including data platform, data pipelines, ML/AI tools, and data Second, we define an implementation plan and success criteria. Next, we source the data and make decisions such as build vs. buy, change data capture (CDC) techniques, and persist raw data in the internal data nstruct: Third, we integrate the data through testing. Next, we transform it into usable formats and structures. Finally, we integrate new data assets with enterprise data, train and refine models, and create new data assets for liver & Consume: Finally, we deliver the alternative data. With effective management of governance of new data assets, availability to business users, data usage patterns and refined dissemination methods, and coordination of data sharing with external partners, the alternative data program is ready to use.

Frequently Asked Questions about alternative data companies

Where can I get alternative data?

Examples of alternative data include:Geolocation (foot traffic)Credit card transactions.Email receipts.Point-of-sale transactions.Web site usage.Mobile App or App Store analytics.Obscure city hall records.Satellite images.More items…

How many alternative data providers are there?

Spending on this data is expected to surpass $1 billion by 2020. In fact, more than 400 alternative data suppliers exist on the market today, so demand and use will only increase.

What is an alternative data source?

What is Alternative Data? Alternative data refers to data used by investors to evaluate a company or investment that is not within their traditional data sources (financial statements, SEC filings, management presentations, press releases, etc.).